Welcome to KKCA Blog

"We work outside of the Box"

We care for our clients and believe to mould every one of them as the one who is alert of his deeds, believes in understanding consequences of following as well as not following the Law, dare to speak the facts/ truths and capable of deciding what he needs….ultimately, advising is our role and selecting the right one is yours.

1st December 2025

It may sound heavy, but every person should have one simple folder on their computer called an “Emergency folder".

This small step brings immense peace of mind. It helps your family access your assets, understand your plans, and avoid legal complications when you are no longer there to explain things.

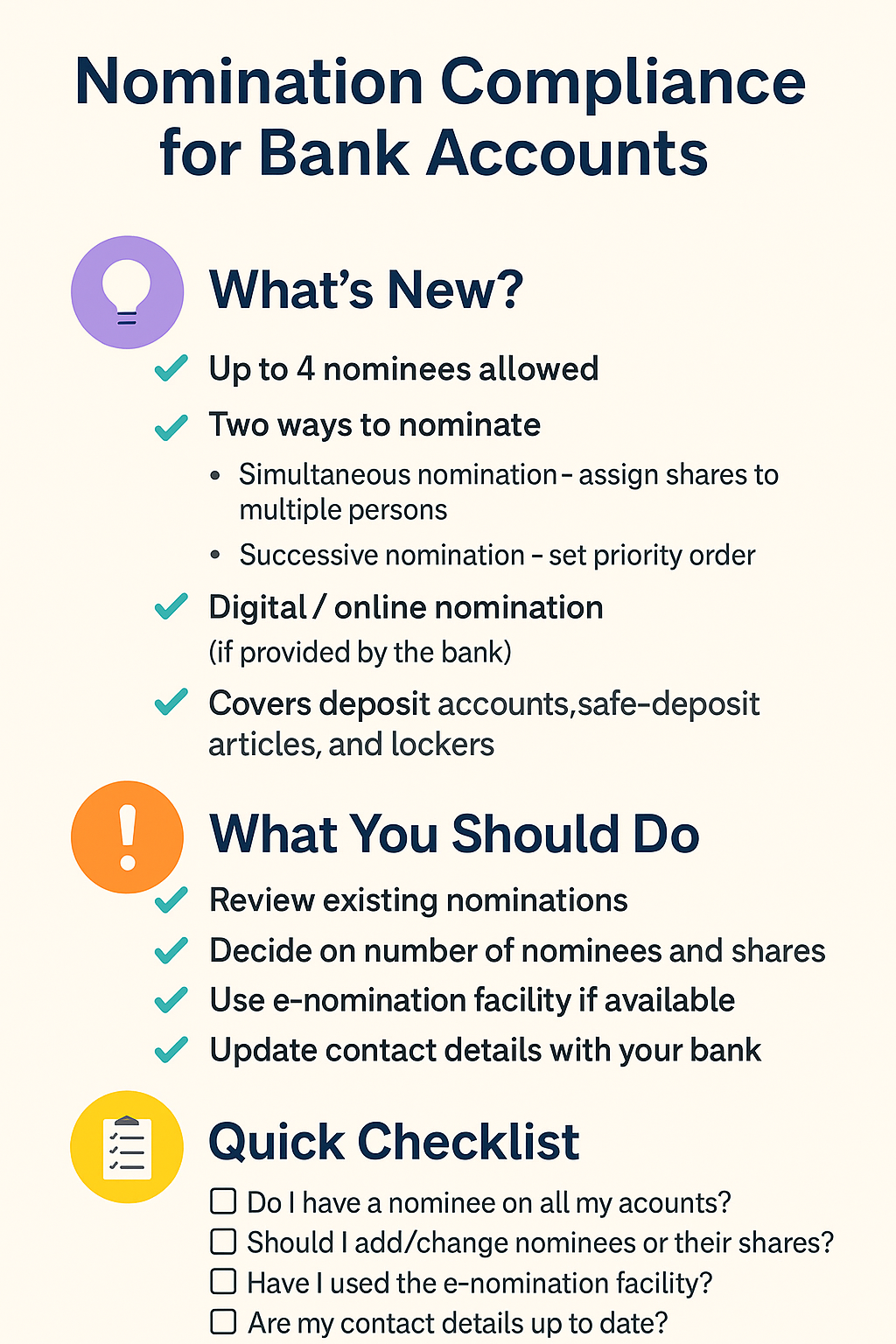

New Nomination Rules for Bank Accounts & Lockers (Effective 1 Nov 2025)

The Government of India has introduced updated rules for nominations in bank accounts, safe-custody articles and lockers. These changes aim to make inheritance smoother, faster and more transparent for your family.

Proud Moment @ KKCA

We are thrilled to share some incredibly inspiring news from the KKCA family! Swanand Joshi, a dedicated student, has achieved the remarkable feat of qualifying as a Chartered Accountant (CA) in his very first attempt, at the young age of 22 in recent exam of Sept 2025.

"Seminar on Tax Audit FY 2024-25 "

On 30th August 2025, CA Milind led professional discussion on the subject of changes in Tax Audit for FY 2024-25 at Pimpri Chichwad Branch of WIRC of ICAI. It was a resolute performance with pulse checking delivery of insightful thoughts. Huge thanks to CA Milind and office bearers of Pimpri Chichwad Branch of WIRC of ICAI.

"Seminar on Changes in ITR Forms FY 2024-25 "

As professionals, we at KKCA and WKCA recognize that learning is a perpetual passion and we deliberately engage in it to ensure our seniors stay updated and our juniors gain valuable insights into professional concepts. This commitment was evident when our partner, CA Ankur Kulkarni, was invited by Pune Branch of ICAI to speak at the Practical Issues in Changes in ITR Forms FY 2024-25 on 11th August 2025.

"Proud Moment @ KKCA "

The unparalleled spirit, unlimited efforts and sky limited enthusiasm of learning, dedication and devotion - the name is CA Mangal.

If you have the determination to dream big and the preparation to work hard for it, you will surely get success. CA Mangal Gaikwad, has proved this in recent CA Final Exam (May 2025).

"1st July- CA Day Celebrations @ KKCA"

We are happy to celebrate this CA day with our students and our esteemed clients. It is only because of you that we have nurtured ourselves as a 'Professional Firm'.

"Yoga Day celebrations @ KKCA"

KKCA believes that education does not mean mere imparting of knowledge or facts but

it encompasses an all round development of an individual. KKCA has been taking all

initiatives to accomplish this. The celebration of International Yoga Day was highly an

exuberant event with enthusiastic participation of the large number of our students. The

main attraction of the day was the performance of Suryanamaskar in which coordination

of body and mind is very important.

Seminar on ITR Filing 2024-25- 7th June 2025

As professionals, we at KKCA and WKCA recognize that learning is a perpetual passion, and we deliberately engage in it to ensure our seniors stay updated and our juniors gain valuable insights into professional concepts. This commitment was evident when our partner, CA Ankur Kulkarni, was invited by WICASA to speak at the Direct Tax Decode seminar for CA students. The session was well-attended and appreciated by the participants. We thank CA Ankur Kulkarni for inspiring young minds and fostering a culture of continuous learning.

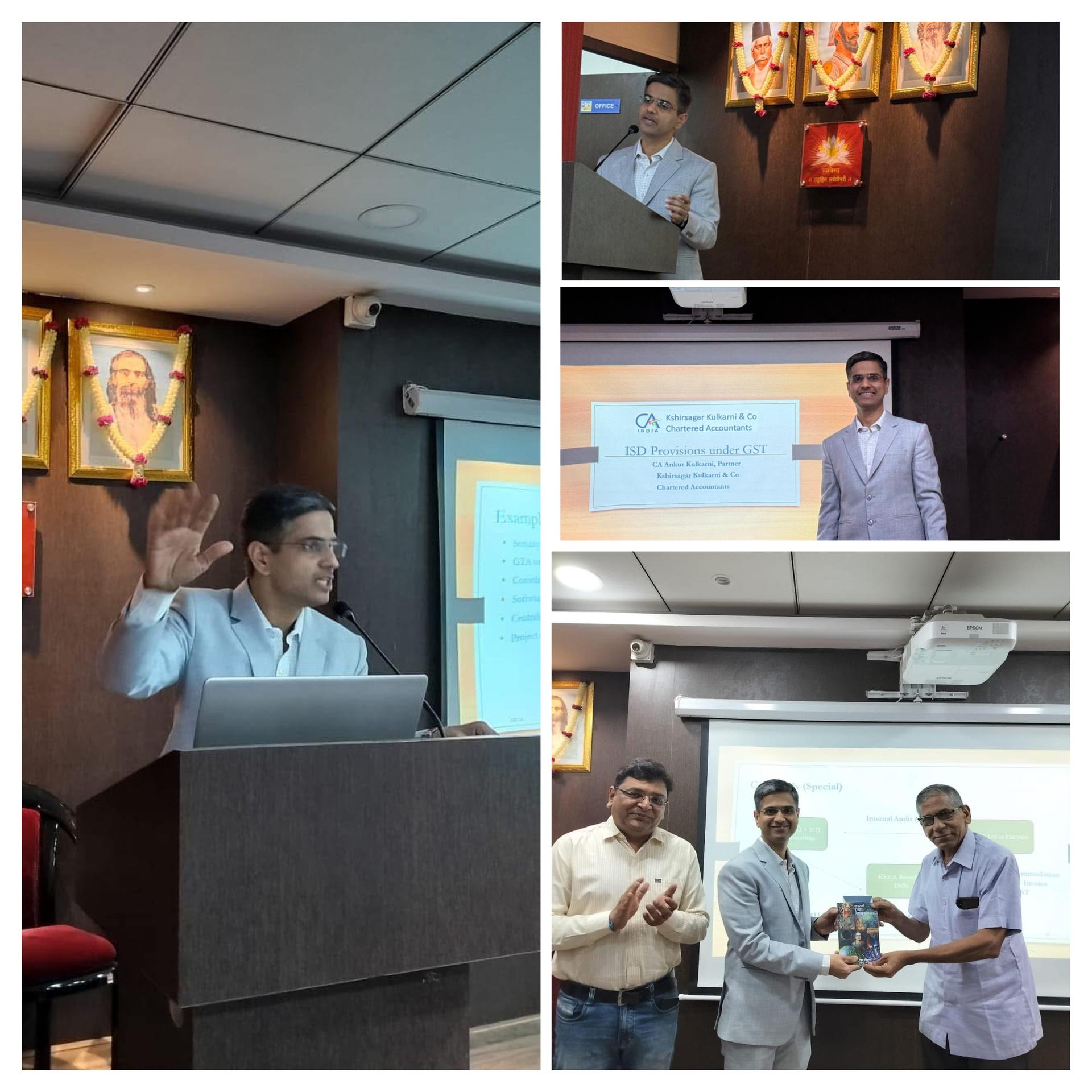

Seminar on ISD Provisions under GST- 1st March 25

As per recently amended GST provisions, with effect from 1st April 2025, ISD provisions are made mandatory. CA Ankur Kulkarni, was invited by Pune City Study Circle for CAs to speak on ISD Provisions under GST on 1st March 2025. Intricate topic made effortlessly understandable. Just Par Excellence! The session was well-attended and appreciated by members.

Newly Qualified CA

Proud moment @ KKCA

We are extremely happy to announce that our student Adish Aoundhe has cleared today CA final exam held in Nov 2024 by Institute of Chartered Accountants of India.

NRI DIY Portal

This portal explicitly provides latest updates to NRI with stepwise actions to be taken. Without any professional help , one can easily get guided and get complied with.

Demat Account for Minor

A demat account is mandatory for investing in shares, exchange traded funds (ETFs) and listed bonds. There may be parents who want to invest in shares in the name of their kids. For this, they need to open a demat account for their minor child.

Threat of Bad Advice

Tax season can be a stressful time for many, and seeking professional help seems like a logical step to ensure accuracy and compliance. However, the threat of bad tax advice looms large, with potentially severe consequences for individuals and businesses alike.

Client On Boarding

We have in place standardize processes end to end which avoid the chaos that comes with having clients on disparate tools and operating within non-standardized processes.

Mandatory Disclosure in tax Return

Capturing data & Tax calculation is very easy with help of technology. However, it is worth mentioning here is that taxpayers should make these disclosures in order to avoid getting a notice from tax department.